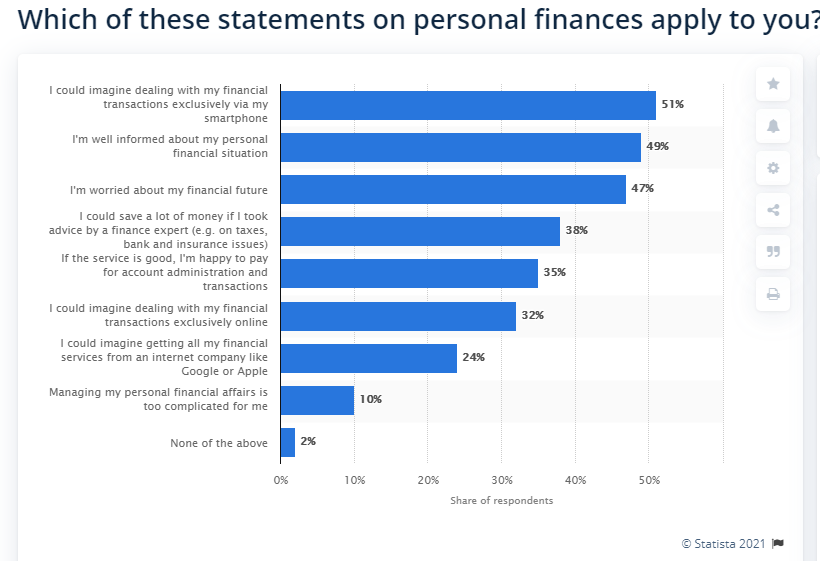

These past few months have had me on some financial know-how kinda vibe. I’ve read, listened to and watched so much financial content that I honestly feel challenged to better myself in this area. In the course of my research, one particular study I found gave a good picture of just how much personal finance impacts our lives. Here is an image that shows the results of a study related to personal finance conducted by Statista Global Consumer Survey conducted in Kenya in 2020.

The results that got me quite interested was that 10% of the population stated that managing their personal finance was “too complicated” for them, 38% of people believe that they could do better with their finances if they took expert advice, and 47% of people stated that they are worried about their financial future! Those are some sobering statistics! Where do you lie?

In the spirit of taking on this financial journey together (because I also have a long way to go), I wanted to get into five simple but transformational changes that you could to your lifestyle to make your finances better than they are now. Even if your finances are already pretty good, they could always be better.

1. Track your expenses

Listening to a truckload of content from Centonomy got me very keen to track my spending. At first, I honestly though that it was way too cumbersome of a habit to try and develop. Track every shilling? Who even has the time to remember all that, right? But as is the nature of binge watching stuff, it starts getting into your head and so I caved and decided to begin right after I got married so that I could start my household off on the right foot.

The first week or so was definitely the hardest because I decided to track even the 20bob I would pay to get to town. But the shock was soon setting in by the third week. My expenditure was crazy! Not that I was a spendthrift or anything, but that I honestly didn’t think that more money went to the supermarket over unnecessary stuff than what went into my savings and investments combined. This is just one example but yours may be different. One thing people sometimes fail to account for even when they commit to tracking expenses is the transaction costs for both bank and MPESA transactions. You would be surprised just how much you spend paying for everything via MPESA instead of cash, even if it’s withdrawing a small amount of money every day or so. Try and add up this week’s transaction costs alone and compare it to how much money you actually transacted and see what percentage of that went into someone else’s pocket. Granted, it is best go cashless during the pandemic but you need to know that it will cost you. How much then can you set aside as “acceptable” transaction costs? And what dark secret do you think will be uncovered when you track your expenses?

2. Pay yourself first

There is an immeasurable amount of information on this topic alone when it comes to personal finance. The premise of it regards saving and investing. We plan for expenses such as rent, utilities, even tithe. But how well do we make plans to keep a share of this for ourselves? In the words of Waithaka Gatumia of Centonomy, “everyone including the landlord, KPLC, and GoK seems to have a plan for your money, except you.”

When setting money aside like you would for your rent, groceries and power bill, have a portion of it go to savings and investments, preferably separately. Savings are for emergencies and working towards long-term goals while investments are the long-term financial goals such as retirement plans and building a home. These are things that have to be consistently and deliberately worked towards. I once heard a preacher ask “Can you pay for your own funeral if you were to die today?” Very scary but realistic question to ask yourself. Invest in benefits such as health and life insurance, have a pension plan, have a money market fund or even join a SACCO. Obviously, all these don’t have to be done at once but purposefully planning towards them is way better than constantly ‘waiting to start next month.’ Research on the different areas you can set money aside for yourself and your future. What are your future financial goals? What are you doing now to make those goals achievable?

3. Be accountable

Financial accountability is important because when there’s nothing or no one checking how money comes in and goes out of your pocket, then it becomes a free-for-all for all the forces tugging at your wallet. Think of this analogy: water has a destructive nature to it when it has no set course such as is the case in floods. However, it can also have a beneficial impact when guided as we see in hydro-electric dams. When you decide where your money is going before it arrives, then it’s easy to make the most efficient use of it.

More importantly, like stated in the previous point, track it so that you’re accountable to the initial plan you made. If you set aside Ksh.10,000 to give away as gifts and contributions, after you have given the Ksh. 1,000 in your friend’s baby shower, Ksh, 1,500 at your neighbor’s farewell party, Ksh. 2,000 for a church project and so on, once the giving pot has run out, that’s your cue to wait for the next month. Obviously, some months will have more or less demands than others and that’s where your understanding of your own situation will come in. Regardless, know what works for you and is reasonable both within your means and according to the needs of your social circles and give it a number. If you’re not sure you’re able to do it by yourself, get a friend who can help you stick to the plan; kinda like gym buddies, be personal finance buddies. How can you keep yourself accountable to your financial plan? Who can help you stick to your plan?

4. Seek minimalism

Now this is where, even for me, I wondered how it was possible to enjoy life while getting rid of things that in my opinion, make me happy, don’t they? Have you ever been to a shop and seen a pair of shoes that make it as though without them your life is empty? Lemme make it personal, this was MY picture of true happiness, I kid you not!

So much so that I wore Converse shoes to my wedding! And of course it looked amazing… (but do I say?)

My point is, some of the things that we believe make us happy are really luxuries which we can do without if we really think about it. Please note that I don’t mean that you should live a miser kind of lifestyle. Not at all! Enjoy life’s pleasures but not every single one of the things that you feel your heart desires because the thing about feelings is that they’re fleeting. The consumerism culture we grew up in and still have now keeps feeding us the lie that we need that one more bag, or that brand new car, or that great outfit to really feel complete yet what we already have is more than enough. To prove it to you, pick just one top in your closet which you haven’t worn in the last three months yet there are others you’ve worn at least twice since that one. Now try and take yourself back to the time you found it wherever it is you bought it. Wasn’t it a ‘steal’ (as we usually say to justify our irrational purchases? Lol!)? But you wore it twice and it wasn’t as cute anymore. Now extend that to all the other stuff like furniture, utensils and even electronics you own and see how much money is sitting idle in your house. Caroline Mutoko once challenged me when she spoke about the one black bag she has that cost I think $400. It sounds like a lot! But she said that if you put together the cost of the average handbags in our houses, they add up to about that number yet they don’t last nearly as long as they should. So why not get just one really good one which may be versatile, durable and cute (imagine it’s possible!). It saves you money, and the time it takes to constantly move things from Monday’s bag to Wednesday’s bag. What do you have that cost you more than its actual value? What can you declutter from your house to either give away or earn a bit of money from it?

5. Plan the fun

This last one is a caveat. The whole article seems very miserable and as though life should be extremely frugal with absolutely no place for joy since it’s an expense. I assure you that that couldn’t be further from the truth! It’s all about being as intentional as possible with your finances so that you’re able to purposefully go through life. What’s the alternative? Living paycheck to paycheck? Now how’s that fun? I guarantee you that this is a way better option than living without a plan. Budgets don’t have to be the ball-and-chain people make it out to be. It’s a great tool to help you live efficiently with as little regret as possible.

Think of the example I gave of the Ksh.10,000 that you put aside for gifts and contributions. The same can be done for your food, fuel and even self-care things like monthly expenditure on manicures, pedicures, massages etc. When money runs out in one account and you’re in the middle of the month, you’re able to evaluate if that’s it for the month or you could find a place to reduce expenditure to make up for dipping your hand in the eating out pot to get a new pair of shoes. It all calls for balance. If your guilty pleasure is collecting art, plan for it. If your reasonable expense a month on this is about Ksh. 5,000 but you can realistically only afford Ksh.3,000 then have a plan to either minimize costs in one area to manage this expense of find another source of income to support this interest. Also, ask yourself if you really need this. If not, the minimalist approach is the way to go because that is money that could go towards your savings and investment which really is one of the most important parts of your personal finance.

I’ll give my example: I’m not big on manicures, pedicures, nail polish, makeup, the whole deal. And I don’t quite try. As I began to check my finances and where I can this vote head got the biggest budget cuts. I decided that whatever I had in my closet was more than enough. These days, rather than spend more than Ksh.1,000 on my nails a month, I go to the nail salon once a month to get a full pedicure and cuticles removed from my fingernails which costs me Ksh.600 which is enough for me. What’s the point of having gel on my nails if doing dishes and laundry won’t let it stay on for more than a week? So because I love sneakers (we’re back to the shoes), I’m able to spoil myself once in a while because I’ve gotten rid of the fluff and excesses. What is it in your life that you really don’t need? Where can you redirect your finances so that you have more leeway to both save and have fun?

The topic of lifestyle changes when it comes to financial goal-setting is one that is choke full of simple strategies but whose implementation takes a lot of discipline and intentionality. Choose to make the most of your finances now rather than look back later at all the things you could have done differently to get a better outcome out of life. The could-have-been ghosts get less and less friendly as you age. Get rid of them now.

This is some wonderful content. Educative.

Thank you for these pointers.

Thanks so much Truddie. Please share it with someone who may find it helpful as well 😊

Wow knw I now mpesa transaction are quite expensive

Now you know…

They really are

#3 felt like it was talking to me.

PS: I’ve done the centonomy program and it did wonders for my personal life and business. I love how youve compressed lessons i needed days to learn in one post. That’s literary talent.

Thanks so much! Super grateful that you read and it was helpful 😊

This is the best thing that I have read this mnth…educative!

I’m so glad! Thanks 😊

Wow! This is a wake up call. Very helpful, thanks for sharing

You’re very welcome ☺

Great content Stacy. Currently, I am tracking my daily expenses and wow the shock. Better to start and now where your money is going. Keep up👏

I’m so glad this was useful. Keep at it and all the best!

Very educative, thank you🙏

I’m glad it was helpful 😊